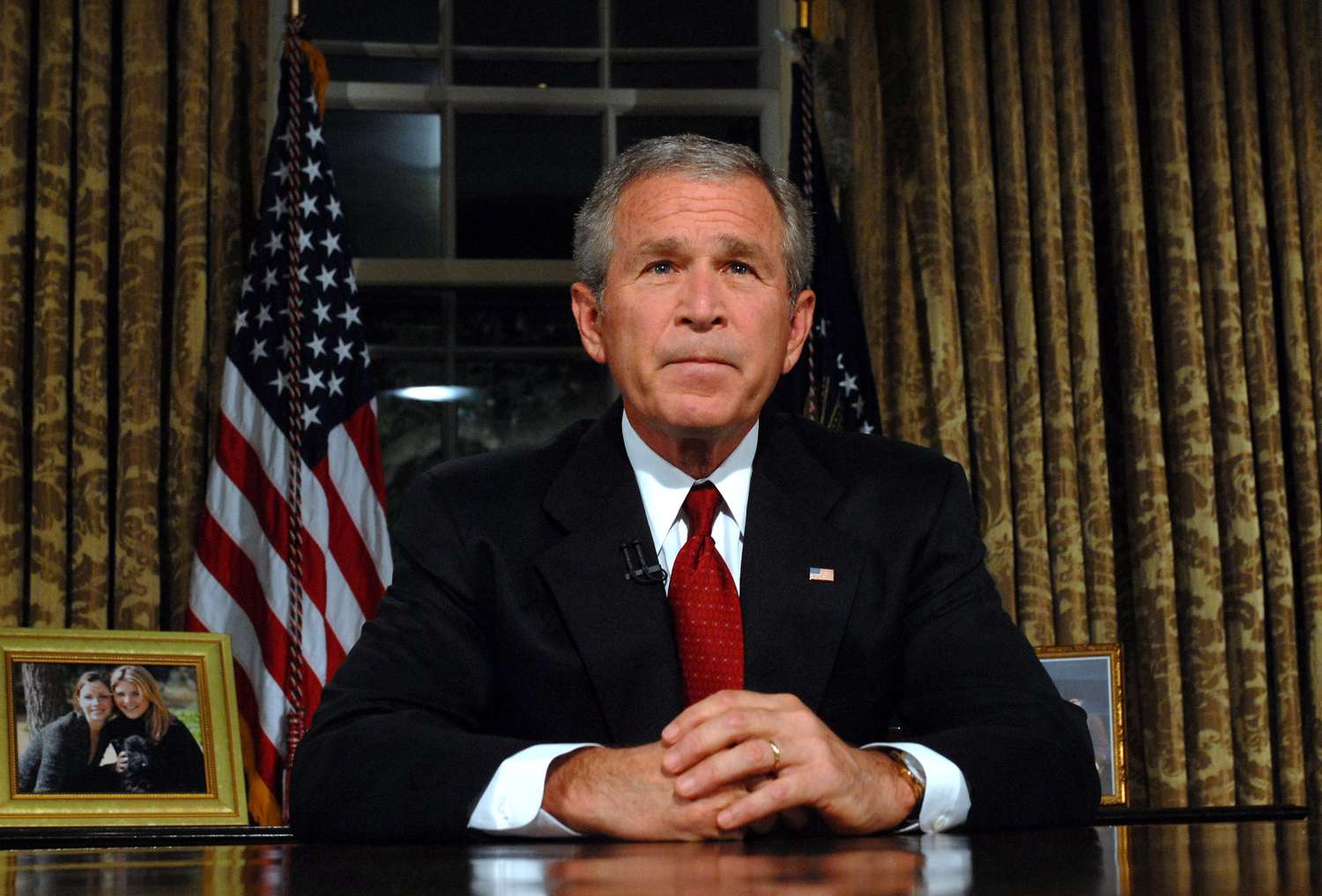

The Bush tax cuts were two tax code changes that President George W. Bush authorized during his first term. Congress enacted tax cuts to families in 2001 and to investors in 2003. They were supposed to expire at the end of 2010. Congress extended them for two more years, and many of the tax provisions remain in effect and continue to affect the economy.

President Bush authorized three major tax cuts in 2001, 2003, and 2008. They had divergent effects on different taxpayers and created a legacy that’s still being felt by many.

Key Takeaways

- President George W. Bush authorized two significant tax cuts in 2001 and 2003 and one income tax rebate in 2008.

- President Barack Obama made a good many of these provisions permanent when he signed the American Taxpayer Relief Act in 2012.

- Statistics indicate that the upper class benefited the most from these tax cuts, although the Child Tax Credit was increased to benefit middle-income taxpayers as part of the 2003 legislation.

EGTRRA Income Tax Cut of 2001

President George Bush authorized the Economic Growth and Tax Relief Reconciliation Act (EGTRRA) in 2001. The intent was to stimulate the economy during the recession that year.

The major provisions of the EGTRRA were to reduce marginal income tax rates and reduce and eventually repeat the estate tax. The Act saved taxpayers as a result, but not equally. The tax cuts benefited high-income individuals the most; Those in the top 1% of households saw their average tax rates fall by 4.1%, compared with only 2% or less for other households. It additionally increased the US debt by $1.35 trillion over a 10-year period.

JGTRRA Tax Cut of 2003

President Bush authorized the Jobs and Growth Tax Relief Reconciliation Act (JGTRRA) in 2003. It reduced tax rates on long-term capital gains and dividends to 15%. It also increased tax deductions for small businesses.

JGTRRA accelerated several provisions in EGTRRA that were taking too long, such as an increase in the standard deduction for married couples. An increase in the child care credit benefited middle-income households, but as with EGTRRA, high-income earners benefited the most.

Income Tax Rebate of 2008

Congress approved the $168 billion Bush tax rebate in early 2008. The rebate amounted to an average of $1,000 per taxpayer. It was sent as a stimulus check, in the mail or electronically, to 130 million households.

That amount should have been enough to boost economic growth. But Lehman Brothers had collapsed by the time the checks went out. The bailout of Fannie Mae, Freddie Mac, and the American Investment Group destroyed confidence in the global banking system. It denied any positive effect of the tax rebates by plunging the US economy into five quarters of recession.

note

The phaseout of the tax reductions did not pan out as expected. This occurred for a number of reasons.

Impact of Expiration on 2010 Midterms

President Obama signed the American Recovery and Reinvestment Act into law in 2009 with the aim of providing tax relief and promoting economic recovery. But frustration over the costs of the economic stimulus package led to the Tea Party movement, which opposed increased spending and growth of the deficit.

Obama had pledged, during his 2008 presidential campaign, that he would allow the Bush tax cuts to expire for those with incomes of more than $250,000 a year. The Tea Party said this would stifle job creation by stealing the small business owners who create 60% of all new jobs. This had an impact on the 2010 midterm elections, which created a Republican majority in the House.

Why the Tax Cuts Never Truly Expired

Congress scheduled the Bush tax cuts to expire in 2010 to comply with the Byrd rule, which prohibits any tax law to increase the deficit beyond 10 years.

But that was a midterm election year. No Congressperson wanted to jeopardize re-election by voting against a proposed extension to the Bush tax cuts and thereby raising taxes on low- and middle-income Americans. Congress and President Obama approved a two-year extension of the tax cuts until 2012 as a result.

The extension was part of the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010. The $858 billion deal cut payroll taxes by 2%. It also extended a college tuition tax credit and revived the estate tax.

EGTRRA should have expired again in 2011. But the economy was struggling to recover from the worst recession since the Great Depression. President Obama signed the American Taxpayer Relief Act in 2012, which made permanent 82% of the Bush tax cuts.

note

The Bush tax cut provisions that expired included reduced income, capital gains, and dividend tax rates, limits on personal exemptions, and reduced estate tax rates.

Economic Impacts of the Bush Tax Cuts

The cuts had the cumulative effect of adding to the debt without significantly boosting growth. The top 1% of households gained an after-tax income increase of 6.7%, while those in the lowest fifth made gains of just 1%.

Research shows no evidence that tax cuts have any impact on the spending habits of upper-income taxpayers. The Bush tax cuts would only increase growth enough to make up 10% of their long-run cost. Maintaining the cuts has been estimated to cost $4.6 trillion from 2012 to 2021.

Drivers of the Bush Tax Cuts

Both political and economic reasons motivated the Bush tax cuts. George W. Bush had voted to cut taxes during his presidential campaign in 2000. He argued when he took office in 2001 in the middle of a recession that tax cuts would help stimulate the sluggish economy and that the surplus from the Clinton administration could help pay for them.

The notion that tax cuts promote economic growth is rooted in supply-side economics, which posits that lower tax rates boost productivity, employment, and output. The theory is based on the Laffer Curve, developed in 1979 by economist Arthur Laffer. The curve depicts how tax cuts affect government revenues.

It suggests that revenues are at zero when the tax rate is zero or 100%. The government can increase rates until a certain point, represented by the peak of the curve, and still increase revenues. But increasing tax rates can reduce revenues, and conversely, reducing tax rates can increase revenues when tax rates are in the so-called “prohibitive range.”

Taxes before the cuts must be in the “prohibitive range” on the curve for the tax cuts to have this impact. Proponents of the Bush tax cuts argued that the tax burden was onerous in the Clinton era, but critics of the Bush tax cuts argued that the government was not in the prohibitive range of tax rates.

Indeed, revenue dropped rather than increased from 2001 to 2003 as the Bush tax cuts were initially rolled out. They didn’t rise until the cuts were fully implemented.

note

Some economists theorize that the recession may have played a role in dampening the potential revenue increase of the tax cuts. But they note that it’s difficult to estimate the extent to which the cuts would have increased revenue in the absence of a recession.

Bush vs. Trump Tax Cuts

Both the Bush- and Trump-era tax cuts increased the deficit and debt, but President Bush’s tax cuts occurred during the 2001 recession and the years immediately following. President Donald Trump’s tax cut occurred while the economy was solidly in the expansion phase of the business cycle.

President Trump signed the Tax Cuts and Jobs Act (TCJA) on December 22, 2017. It cut individual income tax rates, doubled the standard deduction, and eliminated personal exemptions.

The plan lowered the top individual tax rate from 39.6% to 37% and cut the corporate tax rate from a maximum rate of 35% to a flat rate of 21%. The corporate cuts are permanent, while the individual changes expire at the end of 2025.

The TCJA is estimated to increase the deficit by $1 to $2 trillion from 2018 to 2025. It will only increase growth by 0.7% annually, thus reducing some of the revenue loss from the tax cuts.

Frequently Asked Questions (FAQs)

How did the Bush tax cuts affect the economy?

The Center on Budget and Policy Priorities indicates that the Bush tax cuts increased deficits, debt, and income inequality.

How much did the Bush tax cuts save taxpayers?

President Bush has indicated that his tax cuts provided American taxpayers with $1.7 trillion in relief through 2008.